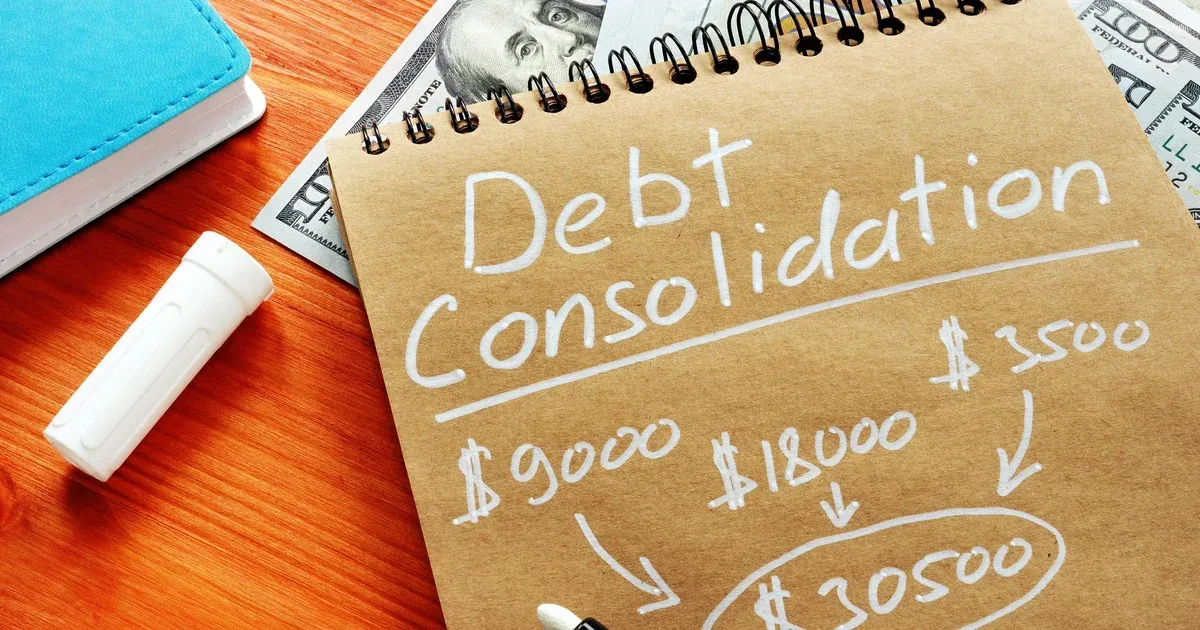

What Is Debt Consolidation

What Is Debt Consolidation

- Single monthly payment – Multiple debts such as credit cards, personal loans, and lines of credit are combined into one.

- Lower interest rates – Consolidation may reduce overall interest compared to high-interest credit cards.

- Simplified debt management – Fewer payments make budgeting easier and reduce missed payments.

Common Types of Debt in Canada

Common Types of Debt in Canada

- Credit card debt – High interest and compounding balances.

- Personal loans – Multiple loans with different repayment terms.

- Lines of credit – Variable interest rates that may increase over time.

- Medical or unexpected expenses – Often carried on high-interest accounts.

How Debt Consolidation Works

Consolidation Loans

- Replace multiple debts – One loan pays off existing balances.

- Fixed repayment schedule – Predictable monthly payments.

- Improved cash flow – Lower monthly obligations in many cases.

Balance Transfer Options

- Lower introductory rates – Temporary interest relief on transferred balances.

- Short-term solution – Requires discipline to avoid new debt.

- Best for smaller balances – Limited by credit limits.

Professional Debt Programs

- Credit counselling services – Structured repayment plans with professional guidance.

- Negotiated interest reductions – Possible lower rates with creditors.

- Education and budgeting support – Helps prevent future debt problems.

Benefits of Debt Consolidation

- Reduced monthly payments – Easier to manage household expenses.

- Lower overall interest – Saves money over time.

- Improved credit stability – Consistent payments support credit health.

- Less financial stress – One clear plan instead of multiple obligations.

Who Can Benefit Most

- Individuals with multiple high-interest debts – Especially credit card balances.

- Households struggling with monthly payments – Consolidation improves cash flow.

- Canadians seeking financial structure – A clear repayment plan restores control.

Things to Consider Before Consolidating

- Total cost of borrowing – Review interest rates and fees carefully.

- Credit impact – Understand how consolidation may affect credit scores.

- Financial habits – Avoid accumulating new debt after consolidation.

- Professional advice – Expert guidance helps avoid costly mistakes.

Why Seek Expert Help

- Free initial assessments – Many services offer no-obligation consultations.

- Customized solutions – Plans tailored to income and debt level.

- Long-term financial planning – Support beyond immediate debt relief.

Conclusion

- Debt consolidation is a proven financial strategy – It simplifies repayment and reduces pressure.

- Early action matters – The sooner debts are addressed, the more options are available.

- Expert guidance leads to better outcomes – Professional support helps Canadians regain financial control.