Why Consider Debt Consolidation

Why Consider Debt Consolidation

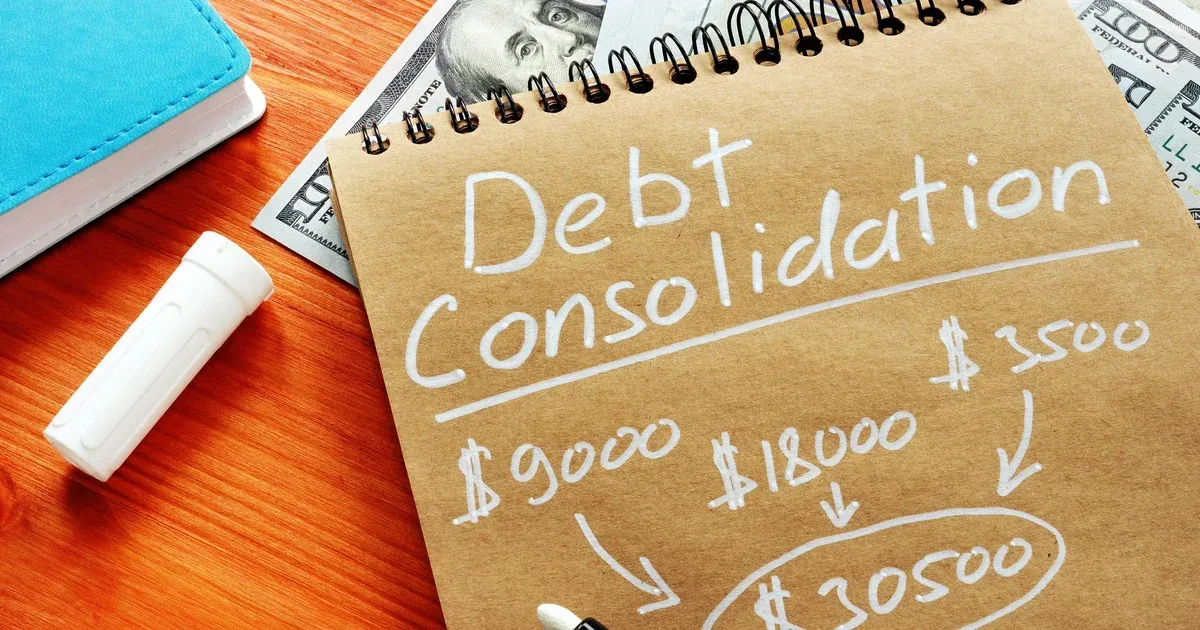

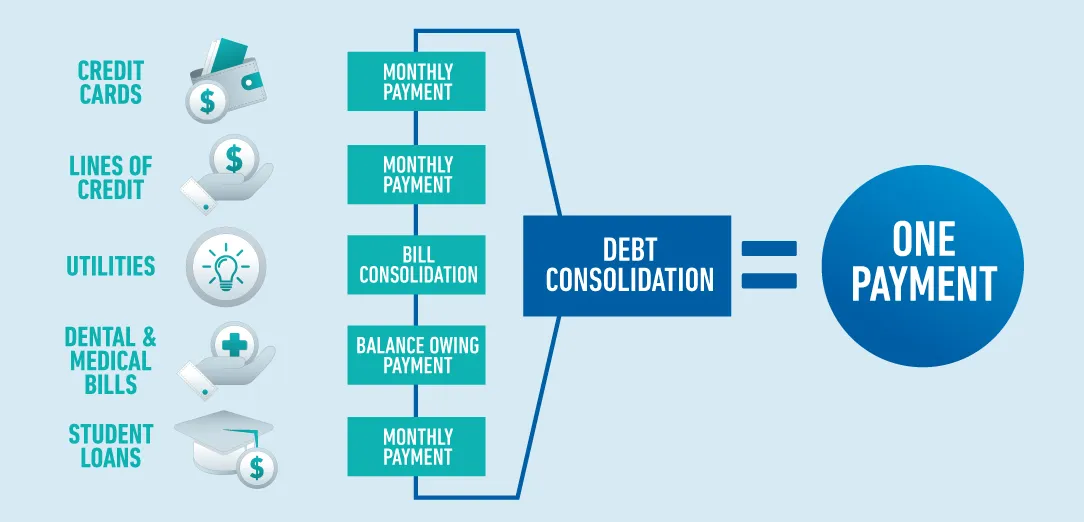

- Simplify multiple debts – Combine credit cards, personal loans, and other debts into one monthly payment.

- Lower interest rates – Potentially reduce overall interest compared to high-rate credit cards.

- Reduce financial stress – Easier to manage and plan your monthly budget.

Types of Debt Consolidation Options

Types of Debt Consolidation Options

Personal Loans

- Fixed interest rates – Predictable monthly payments.

- Flexible terms – Choose repayment periods that fit your budget.

- Quick approval – Some lenders offer same-day or next-day funding.

Balance Transfer Credit Cards

- 0% introductory APR – Temporarily avoid interest charges on transferred balances.

- Short-term debt relief – Ideal for paying off high-interest credit cards quickly.

- Eligibility requirements – Usually requires a good credit score.

Home Equity Loans and Lines of Credit

- Leverage home equity – Lower interest rates than unsecured loans.

- Longer repayment terms – Reduce monthly burden.

- Risk management – Home is collateral; careful planning is essential.

How Personal Loans Can Help

- Debt consolidation – Pay off multiple high-interest debts in one transaction.

- Unexpected expenses – Cover emergencies without using credit cards.

- Financial planning – Fixed payments make budgeting easier.

- Credit improvement – Timely repayments can boost your credit score.

Tips for Choosing the Right Solution

- Compare interest rates – Find the lowest overall cost.

- Check fees and terms – Look for origination fees, prepayment penalties, or hidden charges.

- Assess your credit score – Determine eligibility and best options.

- Plan repayment strategy – Avoid accumulating new debt while paying off existing loans.

Who Should Consider Debt Consolidation and Personal Loans

- Individuals with multiple high-interest debts – Credit cards, payday loans, personal loans.

- People looking to simplify finances – Reduce stress and streamline payments.

- Borrowers planning large expenses – Emergency funds, medical bills, or home improvements.

- Those aiming to improve credit – Consistent repayment can help rebuild credit history.

Conclusion

- Debt consolidation and personal loans are powerful tools – Take control of your financial future.

- Choosing the right option is crucial – Compare rates, terms, and lenders carefully.

- Act now to regain financial freedom – Reduce debt stress and start planning for a brighter future.