Category: Finance

What Is a Bank Statement?

A bank statement is a document prepared by your financial institution each month. With a bank statement, you can see…

How Do Cardless ATMs Work?

It’s easier than ever to pay for things electronically, eliminating the need to handle cash. You can use your phone’s mobile…

How To Ask Your Bank To Waive an Overdraft Fee

When you’re already experiencing financial hardship, getting hit with overdraft fees can be devastating, both emotionally and financially. Even when…

The Difference Between Fiscal and Monetary Policy

Investors hear frequent references to monetary policy and fiscal policy, but many do not know exactly how to differentiate these…

Federal Reserve Tools and How They Work

The federal funds rate is the most well-known Federal Reserve tool. But the U.S. central bank has many more monetary policy tools, and they…

FOMC: What It Is, Who Is on It, and What It Does

The Federal Open Market Committee (FOMC) conducts monetary policy for the U.S. central bank. As an arm of the Federal Reserve System, its…

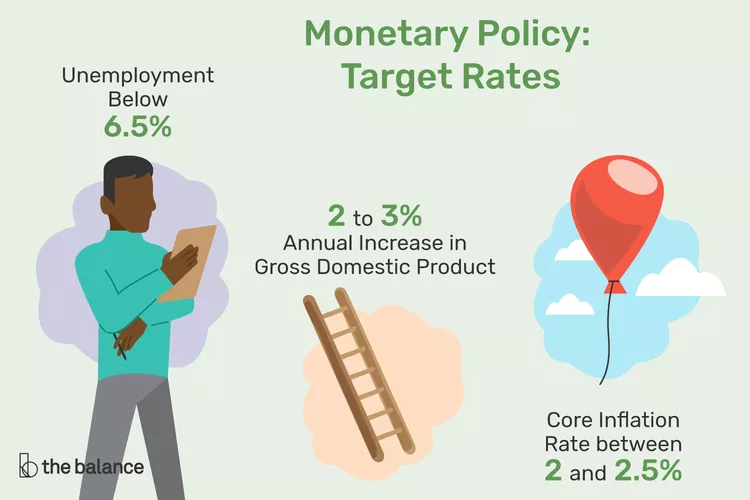

What Is Monetary Policy?

DEFINITION Monetary policy is a central bank’s actions and communications that manage the money supply. Central banks use monetary policy to…

Contractionary Fiscal Policy and Its Purpose With Examples

Contractionary fiscal policy is when the government either cuts spending or raises taxes. It gets its name from the way…

U.S. Federal Government Tax Revenue

U.S. federal tax revenue is made up of the total tax receipts received by the government each year. Most of…